A federal tax credit that has resulted in monthly payments to hundreds of thousands of families in the past six months has gone away with the new year, leaving some federal lawmakers in New England ready to fight for its return but uncertain whether anything can be done to save the expanded child tax credit.

First included in the American Rescue Plan, the expanded credit increased the annual credit in 2021 from $3,000 to $3,600 for every child younger than six years old and raised the credit for children between 6 and 7 to $3,000. For the final six months of the year, parents were allowed to receive direct payments of between $250 and $300 each month, instead of waiting until the end of the year to claim the tax credit.

A one-year extension of the expanded tax credit, which is partly intended to fight childhood poverty, won approval from the U.S. House. But in the closely divided U.S. Senate no Republicans have endorsed it as written, and Democrat Joe Manchin of West Virginia has also rejected it as too costly.

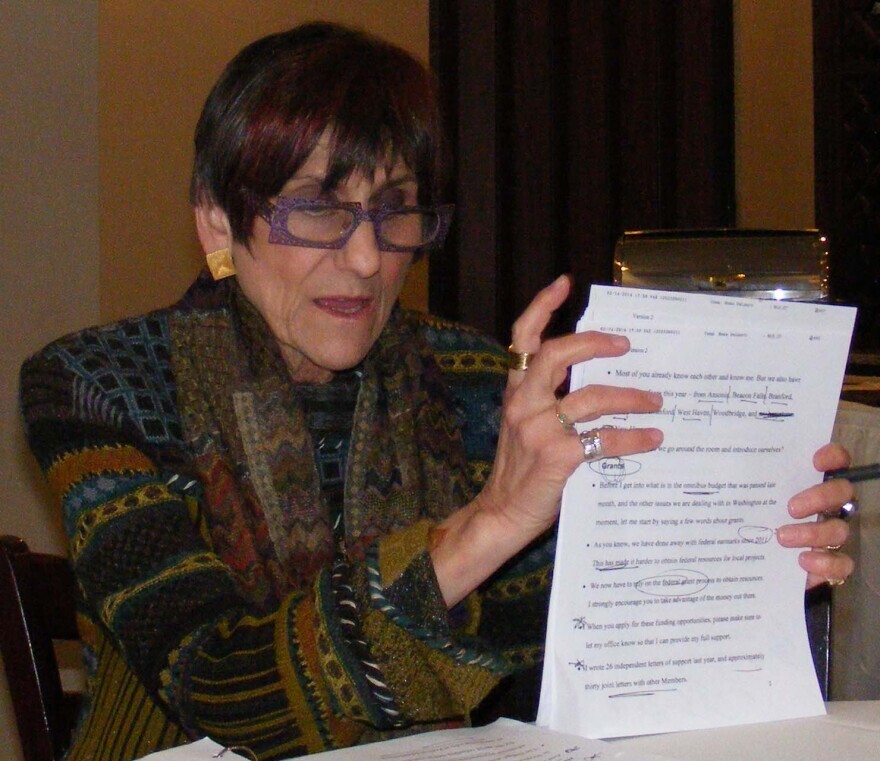

Rep. Rosa DeLaura (D-CT) is among those in Congress fighting see the tax credit restored.

“The November numbers indicate that 3.8 million kids were lifted out of poverty, and we were seeing the hunger in the United States decline as a direct result of the child tax credit. I don't know that there's any other example of a program that has had such enormous success,” DeLaura told And Another Thing.

“Both my wife and I had to plan Thanksgiving dinner, let alone dinners after that around the $500 that we were receiving for the child tax credit,” said Corey Salisbury of New Haven, Connecticut whose unemployment benefits have expired, “We knew Dec was going to be tough with Christmas, with having four girls, including a four month old, and we had to make that $500 stretch not only for food but to make sure that they had a decent Christmas. And January has been a whole other ballgame with not receiving anything at all.”